Introduction

Advances in carbon dioxide removal (CDR) technology are generating new debate around the role of government in their adoption. To date, public policy mechanisms like grants and tax credits have subsidized this technology, but questions linger about whether improved policy mechanisms could accelerate the adoption of CDR at a lower cost to the public. There is also debate regarding the extent to which government should spur CDR technology. Conventional economic theory notes that the presence of private-sector demand for a new technology should diminish the need for public support, but the commodity provided by CDR—reduced pollution— is a public good, which forces considering whether public support is warranted to best capture the benefits.

In this paper, we explain the benefits of CDR technology, its potential future role in both the public and private sectors, and how best to maximize its benefits. Importantly, this paper focuses on discerning whether there are reasonable motivations for public policy regarding CDR technology, and, if so, what structure of policy would yield the greatest benefits at the lowest cost. We focus particularly on reverse auction mechanisms, which traditionally have been highly effective at reducing commodity market costs.

What Is Carbon Dioxide Removal?

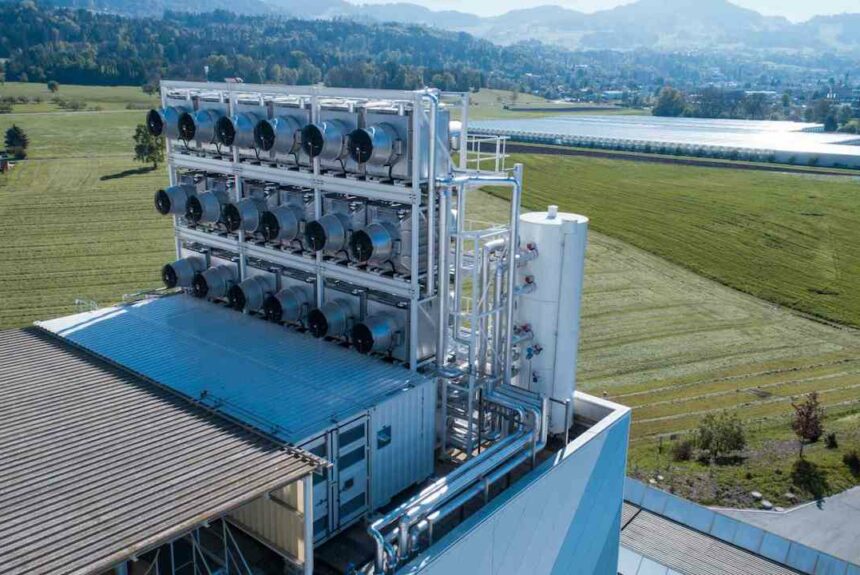

CDR is what it sounds like: removing carbon dioxide (CO2 ) from the atmosphere. Methods of carbon dioxide removal include natural solutions such as afforestation, soil carbon sequestration, and ocean-based CDR.1 In recent years, technological options have emerged to remove CO2 from the atmosphere. Direct air capture (DAC) facilities effectively run air through chemical reactions to extract CO2. This CO2 may then be used for enhanced oil recovery, the creation of synthetic fuels, or piped greenhouses, or it may be stored in geologic repositories or in solid states such as concrete.2 DAC differs from carbon capture and storage (CCS) in that DAC removes CO2 from the atmosphere, whereas CCS technology captures CO2 at the source of emissions (such as the power plant).

CDR offers a promising and potentially transformative option for reducing the financial consequences of climate change and lessening the risk of high-impact tail scenarios. The Intergovernmental Panel on Climate Change (IPCC) emphasizes that CDR is an essential complement to greenhouse gas mitigation strategies that seek to limit human-induced warming to 2 degrees Celsius above pre-industrial levels.3 CDR technologies, if cost effective, could help address the collective-action problem that makes global emissions reductions challenging. Moreover, purchasing CDR credits could be advantageous for firms, particularly for sectors of the economy that are challenging to decarbonize.

To be an effective climate solution, CDR must be transparent, verifiable and durable. A CDR credit for planting a tree or for undertaking soil sequestration, for instance, does little good if the project later releases CO2 or if the practice fails to meaningfully sequester carbon over time.4 Verifying the legitimacy of carbon markets and providing additionality will prevent greenwashing and establish trust in carbon markets. Research institutions, the private sector, federal governments and international organizations have made progress in improving the quality and durability of carbon credits.5 Continued progress on credit verification and monitoring will be critical to ensuring that CDR credit markets are an effective solution to global decarbonization. Cost will be another critical factor.

Carbon Dioxide Removal Public Policy

Enacted laws and legislative proposals offer different mechanism to expand the deployment of DAC technologies. Signed into law by President Joe Biden in November 2021, the Infrastructure Investment and Jobs Act includes an allotment of $3.5 billion over five years for DAC hubs. If carried out successfully, the hubs “each have the capacity to capture and store and/or utilize one million metric tons of CO2 per year, will be networks of DAC projects, potential CO2 off-takers, transportation infrastructure and storage infrastructure.”6

Moreover, the Act includes $115 million for two prize competitions for DAC technologies, $100 million for commercial technologies and $15 million for precommercial technologies.7 DAC facilities can also take advantage of the 45Q targeted tax credit (a subsidy for carbon sequestration) if the facility captures at least 100,000 metric tons of CO2.8

More recently, August 2022’s Inflation Reduction Act (IRA) boosts the value of the credit to $180/ton for DAC storing CO2 in saline geologic formations and $130/ton for utilizing the CO2 for industrial processes or enhanced oil recovery.9 The IRA also broadens the number of DAC facilities that qualify for the credit by lowering the 100,000 metric tons of CO2 threshold to just 1,000 metric tons. In June 2022, the Department of Energy (DOE) launched its Carbon Negative Shot to, within a decade, “capture CO2 from the atmosphere and durably store it at gigaton scales for less than $100/net metric ton of CO2 -equivalent.”10

Another public policy tool under consideration is federal procurement, in which the DOE would purchase carbon dioxide removal credits. The Federal Carbon Dioxide Removal Leadership Act, for instance, would aim to help the DOE achieve its Carbon Negative Shot objectives by requiring the agency to enter contracts for CDR.11 To the extent that it is economically feasible, the legislation would require the DOE to ramp up carbon dioxide removal annually, with a target of 10,000,000 net metric tons of CO2 in 2035.12

Proponents of public procurement argue that a guaranteed customer such as the federal government can help drive down the per-ton cost of removal, disperse public expenditures to nascent technologies and help purchase low-carbon fuels that use captured CO2 as a feedstock.13 Federal procurement could, in fact, help drive down cost and scale up deployment of DAC, but policymakers should be mindful of protecting taxpayers and not overstepping (or worse, impeding the progress of) the private sector. Maximizing efficiency through competition will maximize the value and optimize the efficiency of a procurement process.

Current CDR markets can be thought of as highly nascent, with extremely low supply compared to growing demand.14 Although the estimated social cost of carbon (SCC) is around $50/ton, early CDR credits cost up to $400/ton.15 This is because purchasing firms, such as Shopify, Microsoft and SwissRe, find unique value in the marketing credibility of positioning their brands as being environmentally conscious.

The demand for CDR credits will only keep growing. Several major oil companies, including British Petroleum, Royal Dutch Shell and Total, have committed to achieving carbon neutrality by 2050.16 While this could theoretically be achieved through carbon offsets, firms will likely seek to procure as many CDR credits as possible. Carbon offsets, which are credits for activities that negate or avoid greenhouse gas emissions, have struggled with credibility issues. Many carbon offsets are awarded based on counterfactuals that are unlikely, such as preservation for forests that likely would have never been logged, or the preservation of foreign renewable energy projects that would have been built without carbon offset revenue.17 As past R Street Institute research has noted, there are credible ways to utilize and develop carbon offsets, but given that CDR credits do not have issues with legitimacy, they are likely to be in higher demand for firms that view carbon neutrality as important to their reputation.18

Carbon Dioxide Removal as Public Good

Before exploring the benefits of a competitive procurement process for carbon dioxide removal, it is worth briefly discussing how CDR fits into the economics framework. Excess CO2 emissions are a negative externality in which the costs of warming fall on individuals that did not benefit from the action that produced the emission. Unlike reducing soot from a smokestack or smog from a city, climate change is a global, collective-action challenge because CO2 is dispersed evenly throughout the atmosphere.19 To effectively address human-induced global warming (e.g., slowing sea-level rise and temperature increases), decarbonization is necessary not just in the United States, but also around the world. The global scale of the problem proves challenging, as most future emissions growth will come from developing countries, and there are several sectors of the economy where the cost of emissions abatement is prohibitively high. Even where low-cost alternatives exist, the rapid deployment of those technologies faces regulatory and permitting obstacles or may be held up in court. As an R Street commentary noted, “[e]missions trajectories are more sensitive to regulatory barriers constraining new clean technologies than regulating emissions from the existing fleet.”20

Widescale deployment of DAC could significantly help overcome the collective-action problem of global greenhouse gas emissions. To make economic sense, however, cost reduction is a necessity. The per-ton cost of DAC ($250-$600/ton) is currently much higher than natural carbon dioxide removal solutions or low- or zero-emissions technologies.21 Nevertheless, should developing countries continue to build out their respective coal-generating fleet, cost-competitive DAC could be a necessary means to offset (and meaningfully reduce) emissions from both developed and developing countries.

The private sector has been a leader in DAC research, development and deployment and will be a critical component in any long-term success. Some researchers have likened emissions reductions to trash removal, where public and private options exist. In a 2019 journal article in Frontiers in Climate, one author wrote:

Those seeking deployment of engineered CDR approaches must recognize that this will ultimately be done through a market. It is unlikely that governments will underwrite the costs completely or mandate public expense. Private capital and public & private companies will deliver solutions to these evolving markets, competing with each other for market share. The business model could be similar to the services provided by waste management and pollution control firms—following mandates and regulations, companies would offer CDR services for a fee.22

Carbon dioxide removal can also be looked at through the economic lens of being a public good. Public goods are non-rivalrous and non-excludable. For a good to be non-excludable, one person cannot prevent others from using it (or must do so at an extremely high cost). A non-rival good is a good where one person’s consumption of a good does not affect another person’s ability to consume that good (the marginal costs are zero or extremely low). A common example of a public good is national defense. Jack’s consumption of national defense does not affect Jill’s consumption of national defense, and the Department of Defense cannot provide defense for Jack without also providing it for Jill.

There are certainly private beneficiaries to public goods, such as defense contractors, and determining how much of a public good is necessary is subjective. Yet the rational for public expenditure on public goods is to overcome the free rider problem, in which Jill will wait for Jack to pay for national defense and reap the benefits—and vice versa. If excess CO2 emissions represent a global public bad, CDR is a global public good.23 People across the planet benefit from the positive effect of CDR, and CDR technologies/ expenditures cannot exclude certain people from reaping those benefits. Some people may benefit more than others, as warming has disproportionate negative effects at a regional level; however, a DAC plant in Iceland cannot exclude Americans from receiving the benefits of emissions reductions.24

A single project—regardless of whether that is a solar array or a DAC plant—will have indistinguishable impacts on global temperatures. But the line of thinking that ignores how emissions are reduced fails to recognize how present investment in specific types of carbon dioxide removal could affect (and ideally lower) future price points of low-carbon energy and CDR technologies. Public and private investments and innovations today could pay dividends decades from now if they help make CDR a cost-competitive option for firms. Ultimately, unilateral action on climate change or action that changes the behavior of major emitting countries like China and India will have marginal impact. To the extent that investment can drive down the cost and speed up deployment of emissions abatement and emissions removal, projects today will be instrumental in achieving global decarbonization and/or in reducing the risks and costs of climate change.

Competitive Versus Uncompetitive Public Support for Innovation

The U.S. government disperses money toward innovation through mechanisms that can broadly be thought of as either competitive or uncompetitive. A classic example of an uncompetitive innovation program would be the DOE expenditures on renewable energy research at the National Laboratories, like the HydroWIRES initiative.25 In these programs, the administration selects a research priority, Congress appropriates a budget towards it and then research is conducted under the direction of politically appointed personnel. Under such a system, the money is spent only on research and development (R&D) that aligns with the political priorities of the administration.

By contrast, a competitive system for innovation expenditures partially or completely outsources the R&D outside of government and puts in place a stated objective that determines where R&D funds are directed. As an example, in 2004, the National Aeronautics and Space Administration (NASA) launched the Commercial Orbital Transportation Services (COTS) program, which allowed private companies to compete for NASA funding on rocket launch services, provided they could specify outlines.26 COTS was responsible for the beginning of the commercial space race, where SpaceX and Boeing have been able to significantly reduce the costs of payload launches into orbit. In 2011, NASA space shuttles had a flight cost of about $30,000/ pound of payload (2021 dollars); for comparison, SpaceX has achieved a cost of about $1,200/pound.27

The advantage of competitive mechanisms in innovation is that the approach can stimulate and use sources of innovation that may be unknown to politicians. Politicians are not scientists or industry experts, nor do they have perfect knowledge as to the capabilities of firms within or outside of their authority. In the case of COTS, the falling costs of space flight would never have been possible without commercialized competition. Firms like SpaceX have an incentive to reduce the costs of their programs because lower operating costs increases profit, but government programs have no penalty for financial failure and do not have any incentive to reduce costs.

Innovation can and does still occur within government programs, but only to a point. Government innovation spending that relies on systems that disperse responsibility and management to private or apolitical organizations, like the DOE’s National Labs structure, tend to yield better results than other government-funded innovation efforts. Research on this topic has found that the DOE spends less per patent than other government agencies and spurs more active licenses per patent (a metric of the utilization of produced innovation).28 By contrast, NASA spends more than six times as much per patent produced as the DOE.29 Additional research has found that the DOE, in general, 25. Office of Energy Efficiency and Renewable Energy, “DOE Awards $16M for National Lab Projects Focused on Hydspends nearly twice as much per patent as the private sector, indicating that privatesector innovation tends to be much more efficient than government-led innovation.30

Innovation, though, is a spectrum. Profit motive is important for private-sector-driven innovation, as was seen with the success of COTS. But at times, the potential profit yields from innovation may be too distant to spur private sector innovation effectively. For this reason, early stage, “basic science” R&D is usually invested in through public funds.31 Conversely, for products that are already commercialized and efficient, the private sector tends to be more efficient in its R&D because there are near-term returns on investment and incentives for greater efficiency and more rapid deployment than government-led R&D. For intermediate R&D, called “applied research,” there is considerable debate regarding the degree to which it should be managed by the public or private sector.32

The economic literature on innovation is generally sporadic. Innovation is a highly variable process across firms and market conditions, but typically there are key elements that foster innovation. Firms must have available capital to invest in R&D, and some models suggest that tightly competitive markets can depress innovation by reducing available funds for R&D, but such conclusions are based on modeling assumptions, not real-world data, which generally shows that competitive industries have increased productivity.33 Importantly, findings show that intellectual property rights are important for innovation, as firms may be unwilling to pursue innovation if they fear that they will simply bear the costs of productivity attainment that is later captured by competing firms.34 Additionally, research suggests that larger markets produce higher-quality innovation, owing to the greater potential for capturable profit.35

The Benefits of Competition in Carbon Dioxide Removal Policy

Carbon dioxide removal credits have an interesting but typical energy innovation pathway. The technology is in high demand relative to supply, but the total market demand at current prices is still modest and limits the total available capital, thus stymieing the market entry of new technologies. This is similar to other clean energy technologies, such as solar panels, which for many years were uneconomic and purchased primarily for environmental reasons or in marginal use cases.36 Yet, in the past decade, solar prices have fallen by 82 percent, and, at lower costs, the demand of solar panels has increased markedly, with utility scale photovoltaic solar capacity today over 100 times larger than 2010 levels.37

Similarly, a decrease in the cost of CDR technology would likely spur even greater demand. The current and future market for carbon dioxide removal can be thought of as forward looking but with less-immediate profit motivation for market entry.

In considering policy design that would stimulate market entry for carbon dioxide removal technology, policymakers must consider what a CDR credit should look like in the future. The hope for a CDR credit is that it would be low cost, abundant and accessible to private actors— which is to say, available to consumers and firms that are not politically connected. In effect, CDR credits should look more like solar panels, available to any who choose to buy them freely on the market. Conversely, we do not want CDR credits to look like the passenger rail industry, where large subsidies and substantial regulation prevent market entry and constrain rail service to companies that form effective monopolies to provide services at a substantial cost to taxpayers.38

Essentially, getting CDR markets to an ideal point may require some form of public support in the near term, as there is only a low level of demand for CDR currently. But this public support should be temporary and competitive in nature to avoid stifling the future market entry needed to stimulate competition and reduce costs. This is especially important due to the wide array of competing CDR technologies being researched today, as inappropriate public policy could prevent the most efficient technologies from entering the market. The anticipated large future demand for CDR credits will stimulate private sector market entry and innovation in the future, but because those markets may not be in full force for another decade, the profit motive may be insufficient to incentivize market entry presently.

The U.S. government could employ a variety of policy mechanisms to stimulate the market entry of CDR technology, but not all of them would be equally effective, and some may incur greater economic impacts than others. Generally, the more neutral the government is in any sort of subsidy mechanism, the more efficient outcomes tend to be; the more specific the government is, the worse the outcomes are.

If the U.S. government subsidizes CDR technology, it should avoid mechanisms similar to the Production Tax Credit (PTC) or Investment Tax Credit (ITC). Designed to stimulate growth of wind and solar power technology, these tax credit subsidies began in the 1990s.39 The credits succeeded in generating new production of these resources, but the credits have also been criticized for their technology-specific structure that gives wind and solar power an unfair competitive advantage over other zero-emission technologies. For relatively nascent technologies, like CDR, there will be a temptation among politicians to assign tax credits or grants for specific types of CDR that they feel should be adopted, regardless of their economic or competitive merits. Such policies may stimulate the near-term entry of new CDR technologies but could be problematic in the long term as sunsetting clean-energy policies is politically difficult, and the persistence of technology-specific subsidies means that potentially better future technologies would be disadvantaged. Such policy mechanisms could, in fact, slow global decarbonization efforts by trapping public and private resources in unproductive places.

Technologically neutral subsidies, by contrast, do not risk impeding the market entry of competing technologies that fulfill the same conditions. As an example, the 45Q tax credit of up to $50/ton is available for any industrial sequestration of CO2 regardless of the technology used, with a reduced credit for CO2 that is utilized (such as enhanced oil recovery). A tax credit like 45Q would be more efficient than a technology-specific credit like the PTC or ITC but also entails its own problems for innovation. When a tax credit is a set amount, it can weaken incentives for innovation when the value of the credit exceeds the capturable profit from improved efficiency. As an example, in some cases, the value of the PTC can exceed the cost of electricity, meaning that wind energy producers can give away or even pay customers to take their product and still make a profit.40 In such an event, the presence of the tax credit diminishes incentives for efficiency because firms can be profitable without innovation. If CDR credits fall in cost as hoped, a tax credit like 45Q could become a future barrier to innovation.

A better way of supporting innovation without forgoing the benefits of competition and market forces would be to have public-support policies that are modeled on other competitive policies. Although not an innovation subsidy, cap-and-trade programs incentivize economically efficient innovation by having prices that rise when there is a greater innovation need and fall when the market demand is satisfied.41 Tradable permits under cap-and-trade establish a flexible property rights mechanism for market participants to reduce emissions at lower costs. The Acid Rain Program’s cap-and-trade mechanisms successfully led to cost-effective implementation of pollution-controlling mechanisms in U.S. coal plants.42 It was initially estimated that the program would cost over $6.1 billion, but the actual cost was only $1.1-1.7 billion due to the ability of the market to direct capital to its most efficient abatement opportunities.43 For CDR, similar market-based policies would likely yield better results for cost reduction of technology than direct subsidies.

Of particular interest is the utilization of a reverse-auction in which the government procures CDR credits; the reverse-auction is a system that was already proposed through the Carbon Removal and Emissions Storage Technologies (CREST) Act.44 Such a system can be more effective than other types of climate-related subsidy schemes but can also entail problems if not administered properly.

Reverse Auctions

A reverse auction is a system in which a buyer procures a product through a competition of bids and then selects the lowest-cost product. Reverse auctions incentivize productivity, efficiency and quality among bidders. A classic example of a reverse auction is military procurement, which the United States has employed since 2000. While there is little analysis of the effectiveness of these programs, one study found that the use of auction-style mechanisms significantly reduced procurement costs and that observed data matched closely with economic theory.45 A Government Accountability Office report found that reverse auctions specifically saved the government up to $100 million in 2016.46 Competitive pricing mechanisms, like an auction, simply reduce costs.

A reverse auction for CDR credits, funded by public dollars, would likely yield a more efficient innovation investment than alternative, publicly funded subsidy types due to the potential for competition. A structure for reverse auction, like the one outlined in the CREST Act—a bill aimed at providing public support for new CDR technology— would result in initially high costs per CDR credit, but would stimulate competition as the program matures because it incentivizes multiple entrants to the program.47 Title II of the Act offers a tiered, competitive, public purchasing program for CDR based on how long the CO2 is stored.

As a hypothetical, if a reverse auction were held for $1 million for as many credits as could be purchased and only one firm was able to meet the criteria, there would be no incentive to sell any more credits than needed to claim the full value of the auction, potentially only a single credit. However, at a price of $1 million per credit, any firms able to produce CDR credits below that price would then compete and reduce the costs per credit. The reverse auction model incentivizes as many market entrants as are cost competitive.

As noted earlier, there is significant private-sector interest in CDR technology over the long term. It is likely that the total market size of private actors will exceed any potential CDR procurement effort that taxpayers would support. Energy expenditures in the United States are roughly $1.2 trillion annually, whereas taxpayer-supported energy subsidies are about $17 billion annually.48 Previous R Street Institute research has noted that, for many energy-intensive industries, it would be far more economically efficient to offset their emissions rather than to invest in emission abatement.49 If increased investment in CDR technology increases its availability, which it should, then it is better for long-term CDR markets to be primarily private, as private buyers would likely support a larger market than the public is willing to, even though publicly funded CDR markets may be more efficient at reducing costs in the near term.

One possible option for an expansion of the reverse auction mechanism proposed in the CREST Act would be to couple the reverse-auction procurement of CDR credits with an auction of CDR credits to the private sector. In this way, the costs of the program would be offset by sales of CDR credits, and the value of the subsidy would correspond to the cost-differential between private demand for CDR technology and the current costs of producing CDR credits, leading to an overall more efficient use of taxpayer dollars. As the costs come down and demand increases, the total subsidy from the program would decline, and eventually, if CDR credits command a higher price than they cost to produce, CDR producers would be incentivized to sell their credits directly to private consumers rather than the government, thus leading to a natural sunset of the program.

Crowding Out

While a reverse auction is an efficient policy for reducing costs of technology and is well suited to stimulating cost reduction for CDR technology, the policy as a standalone issue is incomplete and could entail future economic or environmental challenges—chief of which is the potential for crowding out. Crowding out is an economic phenomenon in which public spending or procurement has displaced private consumers. As a hypothetical, if the government decided to buy as many iPhones as possible, private consumers of iPhones would be crowded out of the market and then Apple would be sustained by public dollars, rather than private dollars. While public spending entails a good that arises from spending, it also entails a harm caused by the negative impact in the raising of the funds, that is, the harm caused by increased taxes. It is better for commodities to be bought on the private market because it avoids opportunity costs, as private consumers are incentivized to purchase items that maximize utility for their spending. While this paper does not advocate for any specific climate program or subsidy, we feel that it is important to note that a competitive mechanism like a reverse auction is expected to be far more efficient at stimulating market entry and innovation for CDR than alternative programs such as grants, 45Q expansions or regulatory mandates.

Conclusion

For the public and private sector alike, CDR technologies have become a compelling mechanism to reduce greenhouse gas emissions. While many CDR technologies are in the early stages of deployment, more widescale deployment implementation could help overcome the collective action challenges that have made global climate change such a difficult problem to address. Given the public benefits of CDR (as modest as they may be), there is an economic rationale for public policy support. However, policy details matter. If designed with competition, CDR policies could increase economic efficiency, protect the taxpayer and help drive cost reductions. If designed incorrectly or if policy oversteps the role of the private sector, government intervention could misallocate resources and impede the progress of the very technologies it aims to promote.

About the Authors Philip Rossetti is a senior fellow for Energy and Environmental Policy at the R Street Institute. He has worked extensively on energy policy, environmental issues and climate change. Prior to joining the R Street Institute, Rossetti supported the minority staff of the Select Committee on the Climate Crisis in the U.S. House of Representatives. Before that he was the Director of Energy Policy at the American Action Forum. Nick Loris is the Vice President of Public Policy at C3 Solutions. Loris studies and writes about a wide range of energy and climate policies, including natural resource extraction, energy subsidies, nuclear energy, renewable power and energy efficiency. He also studies ways in which markets can improve the environment, reduce emissions and better adapt to a changing climate.

References

1. Scott C. Doney et al., “A Research Strategy for Ocean-based Carbon Dioxide Removal and Sequestration,” The National Academy of Sciences, December 2021. https://nap.nationalacademies.org/catalog/26278/a-research-strategy-for-ocean-based-carbon-dioxide-removal-and-sequestration.

2. Christa Marshall, “In Switzerland, a giant new machine is sucking carbon directly from the air,” Science, June 1, 2017. https://www.science.org/content/article/ switzerland-giant-new-machine-sucking-carbon-directly-air; Katie Lebling et al., “6 Things to Know About Direct Air Capture,” World Resources Institute, May 2, 2022. https://www.wri.org/insights/direct-air-capture-resource-considerations-and-costs-carbon-removal.

3. James Temple and Casey Crownhart, “UN climate report: Carbon removal is now ‘essential,’” MIT Technology Review, April 4, 2022. https://www.technologyreview. com/2022/04/04/1048832/un-climate-report-carbon-removal-is-now-essential.

4. Andong Cai et al., “Declines in soil carbon storage under no tillage can be alleviated in the long run,” Geoderma 425 (Nov. 1, 2022). https://www.sciencedirect.com/ science/article/abs/pii/S0016706122003354?dgcid=coauthor.

5. Alex Hanafi, “Carbon Credit Quality Initiative,” Environmental Defense Fund, Aug. 3, 2021. https://www.edf.org/climate/carbon-credit-quality-initiative.

6. “The Infrastructure Investment and Jobs Act: Opportunities to Accelerate Deployment in Fossil Energy and Carbon Management Activities,” The U.S. Department of Energy, last accessed Sept. 13, 2022. https://www.energy.gov/sites/default/files/2021-12/FECM%20Infrastructure%20Factsheet.pdf.

7. Ibid.

8. Angela C. Jones and Molly F. Sherlock, “The Tax Credit for Carbon Sequestration (Section 45Q),” Congressional Research Service, June 8, 2021. https://sgp.fas.org/ crs/misc/IF11455.pdf.

9. “The Inflation Reduction Act Includes Significant Benefits for the Carbon Capture Industry,” Gibson, Dunn & Crutcher LLP, Aug. 16, 2022. https://www.gibsondunn. com/the-inflation-reduction-act-includes-significant-benefits-for-the-carbon-capture-industry.

10. Office of Fossil Energy and Carbon Management, “Carbon Negative Shot,” The U.S. Department of Energy, last accessed Sept. 13, 2022. https://www.energy.gov/ fecm/carbon-negative-shot.

11. Sen. Chris Coons, “Federal Carbon Dioxide Removal Leadership Act of 2022,” coons.senate.gov, last accessed Sept. 13, 2022. https://www.coons.senate.gov/imo/ media/doc/federal_carbon_dioxide_removal_leadership_act_bill_text.pdf.

12. Ibid.

13. Direct Air Capture Advisory Council, “The Case for Federal Support to Advance Direct Air Capture,” Bipartisan Policy Center, June 2021. https://bipartisanpolicy.org/ download/?file=/wp-content/uploads/2021/06/BPC_FederalCaseForDAC-final.pdf.

14. Matthias Honegger et al., “Who Is Paying for Carbon Dioxide Removal? Designing Policy Instruments for Mobilizing Negative Emissions Technologies,” Frontiers in Climate 3:672996 (June 7, 2021). https://www.frontiersin.org/articles/10.3389/fclim.2021.672996/full.

15. Susanna Twidale, “Swiss Re, UBS among founding buyers in carbon removal scheme,” Reuters, May 22, 2022. https://www.reuters.com/business/sustainablebusiness/swiss-re-ubs-among-founding-buyers-carbon-removal-scheme-2022-05-22.

16. James Murray, “Which major oil companies have set net-zero emissions targets?” NS Energy, Dec. 16, 2020. https://www.nsenergybusiness.com/features/oilcompanies-net-zero.

17. Ben Elgin, “These Trees Are Not What They Seem,” Bloomberg, Dec. 9, 2020. https://www.bloomberg.com/features/2020-nature-conservancy-carbon-offsetstrees/#xj4y7vzkg.

18. Philip Rossetti, “Economic and Environmental Potential of Carbon Offsets may be Underestimated,” R Street Policy Study No. 243, Oct. 20, 2021. https://www. rstreet.org/2021/10/20/economic-and-environmental-potential-of-carbon-offsets-may-be-underestimated.

19. See, e.g., Zeke Hausfather, “Analysis: ‘Global’ warming varies greatly depending where you live,” CarbonBrief, Feb. 7, 2018. https://www.carbonbrief.org/analysisglobal-warming-varies-greatly-depending-where-you-live.

20. Devin Hartman and Philip Rossetti, “EPA decision has major legal ramifications, but minor climate impact,” R Street Institute, June 30, 2022. https://www.rstreet. org/2022/06/30/epa-decision-has-major-legal-ramifications-but-minor-climate-impact.

21. Lebling et al. https://www.wri.org/insights/direct-air-capture-resource-considerations-and-costs-carbon-removal.

22. S. Julio Friedmann, “Engineered CO2 Removal, Climate Restoration, and Humility,” Frontiers in Climate 1:3 (July 26, 2019). https://www.frontiersin.org/ articles/10.3389/fclim.2019.00003/full.

23. S. Niggol Seo, “An Introduction to the Behavioral Economics of Climate Change for Provision of Global Public Goods,” The Behavioral Economics of Climate Change, (Academic Press, 2017), pp. 1-32. https://doi.org/10.1016/B978-0-12-811874-0.00001-5.

24. Piers Forster et al., “Sixth Assessment Report,” Intergovernmental Panel on Climate Change, 2021, pp. 2466-2473. https://www.ipcc.ch/report/ar6/wg2/ downloads/report/IPCC_AR6_WGII_Chapter16.pdf.

25. Office of Energy Efficiency and Renewable Energy, “DOE Awards $16M for National Lab Projects Focused on Hydropower’s Role in a Clean Energy Future,” The U.S. Department of Energy, Nov. 2, 2021. https://www.energy.gov/eere/articles/doe-awards-16m-national-lab-projects-focused-hydropowers-role-clean-energy-future.

26. “Commercial Orbital Transportation Services,” National Aeronautics and Space Administration, Aug. 3, 2017. https://www.nasa.gov/commercial-orbitaltransportation-services-cots.

27. Denise Chow, “To cheaply go: How falling launch costs fueled a thriving economy in orbit,” NBC News, April 8, 2022. https://www.nbcnews.com/science/space/ space-launch-costs-growing-business-industry-rcna23488.

28. Philip Rossetti and Sejla Avdic, “How to Get the Most Out of the Government’s Research Spending,” American Action Forum, Nov. 16, 2018. https://www. americanactionforum.org/research/how-to-get-the-most-out-of-the-governments-research-spending.

29. Ibid.

30. Philip Rossetti, “Publicly Funded National Labs Important to U.S. Innovation,” American Action Forum, Feb. 14, 2018. https://www.americanactionforum.org/ research/publicly-funded-national-labs-still-important-u-s-innovation.

31. James Pethokoukis, “In Praise of Science Investment, Especially Basic Research,” American Enterprise Institute, Sept. 28, 2020. https://www.aei.org/economics/inpraise-of-science-investment-especially-basic-research.

32. Ben S. Bernanke, “Promoting Research and Development: The Government’s Role,” Board of Governors of the Federal Reserve System, May 16, 2011. https://www. federalreserve.gov/newsevents/speech/bernanke20110516a.htm.

33. Guillermo Marshall and Alvaro Parra, “Innovation and competition: The role of the product market,” International Journal of Industrial Organization 65 (July 2019), pp. 221-247. https://www.sciencedirect.com/science/article/pii/S0167718719300207?via%3Dihub; “Annual labor productivity and costs: detailed industries,” Bureau of Labor Statistics, June 30, 2022. https://www.bls.gov/productivity/tables/labor-productivity-detailed-industries.xlsx.

34. Richard J. Gilbert, “Competition and Innovation,” Journal of Industrial Organization Education 1:8 (February 2006), pp. 1-22. https://www.researchgate.net/ publication/4746508_Competition_and_Innovation.

35. Philippe Aghion et al., “The Heterogeneous Impact of Market Size on Innovation: Evidence from French Firm-Level Exports,” Harvard University Working Paper, June 2020. https://scholar.harvard.edu/files/aghion/files/heterogeneous_impact_of_market_size_jun2020.pdf.

36. Elizabeth Chu and D. Lawrence Tarazano, “A Brief History of Solar Panels,” Smithsonian Magazine, last accessed Sept. 13, 2022. https://www.smithsonianmag.com/ sponsored/brief-history-solar-panels-180972006.

37. “Documenting a Decade of Cost Declines for PV Systems,” National Renewable Energy Laboratory, Feb. 10, 2021. https://www.nrel.gov/news/program/2021/ documenting-a-decade-of-cost-declines-for-pv-systems.html; “Table 4.2.B. Existing Net Summer Capacity of Other Renewable Sources by Producer Type, 2010 through 2020 (Megawatts),” U.S. Energy Information Administration, 2021. https://www.eia.gov/electricity/annual/html/epa_04_02_b.html.

38. Randal O’Toole, “Amtrak’s Big Lie,” Cato Institute, Jan. 14, 2020. https://www.cato.org/commentary/amtraks-big-lie.

39. Molly F. Sherlock, “The Renewable Electricity Production Tax Credit: In Brief,” Congressional Research Service, April 29, 2020. https://sgp.fas.org/crs/misc/R43453.pdf.

40. Josiah Neeley, “Understanding Negative Prices in the Texas Electricity Market,” R Street Institute, Aug. 31, 2021. https://www.rstreet.org/2021/08/31/ understanding-negative-prices-in-the-texas-electricity-market.

41. Will Kenton, “Cap and Trade,” Investopedia, Dec. 5, 2020. https://www.investopedia.com/terms/c/cap-and-trade.asp.

42. Juha Siikamäki et al., “The US Environmental Protection Agency’s Acid Rain Program,” Resources for the Future, Nov. 28, 2012. https://www.rff.org/publications/ issue-briefs/the-us-environmental-protection-agencys-acid-rain-program.

43. Gabriel Chan et al., “The US sulphur dioxide cap and trade programme and lessons for climate policy,” Vox EU, Aug. 12, 2012. https://voxeu.org/article/lessonsclimate-policy-us-sulphur-dioxide-cap-and-trade-programme.

44. CREST Act of 2022, S. 4420, 117th Congress. https://www.congress.gov/bill/117th-congress/senate-bill/4420.

45. Bruce G. Linster and David R. Mullin, “Auctions in Defense Acquisition: Theory and Experimental Evidence,” Acquisition Review Quarterly (Summer 2002), pp. 212- 223. https://www.dau.edu/library/arj/ARJ/arq2002/LinsterSM2.pdf.

46. “Reverse Auctions: Additional Guidance Could Help Increase Benefits and Reduce Fees,” U.S. Government Accountability Office, July 18, 2018. https://www.gao. gov/products/gao-18-446.

47. CREST Act of 2022. https://www.congress.gov/bill/117th-congress/senate-bill/4420/text.

48. Brett Marohl, “In 2019, U.S. inflation-adjusted energy expenditures fell 5%,” U.S. Energy Information Administration, Sept. 9, 2021. https://www.eia.gov/ todayinenergy/detail.php?id=49476.

49. Rossetti, “Economic and Environmental Potential of Carbon Offsets may be Underestimated.” https://www.rstreet.org/2021/10/20/economic-and-environmentalpotential-of-carbon-offsets-may-be-underestimated.