Every day, people around the world innovate to make the world a better place. Whether it be breakthroughs in clean power generation, a new vaccine to combat illness, or artificial intelligence to improve business operations, technological advancements provide countless benefits to society and consumers. Whether those ideas start in someone’s garage or in a multi-billion-dollar research facility, the policy conditions that protect and enable an idea to flourish in the market are essential to the process. Economically free countries set the stage for innovators to innovate. Business freedom, property rights, and government integrity drive innovation, research and development, and technological breakthroughs. Innovation leads to cleaner sources of energy, more efficient modes of transportation, and more cost-effective emissions reductions.1 These benefits in turn lead to higher levels of prosperity, fewer pollution related deaths, and more efficient and sustainable land use and management.

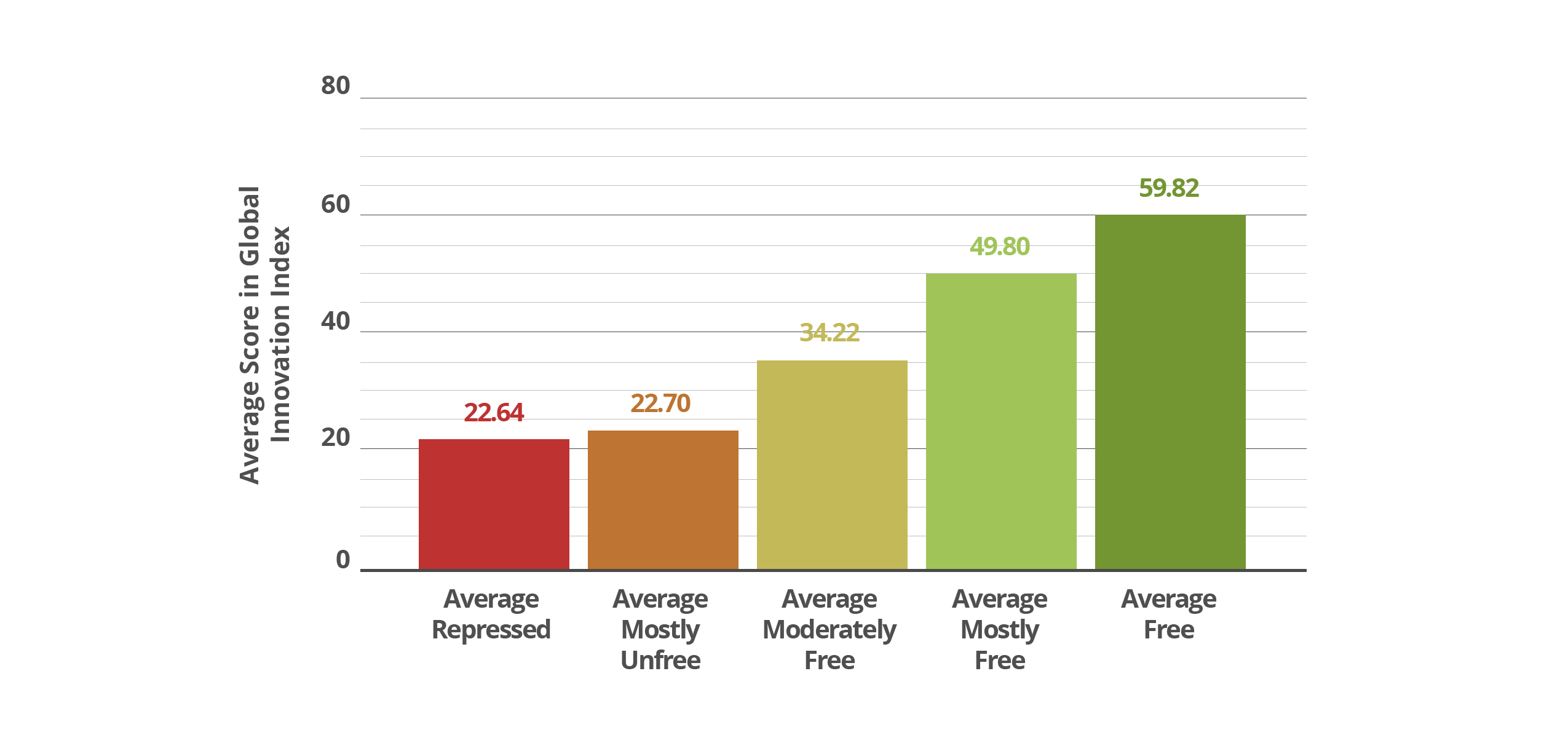

In comparing the Index of Economic Freedom with the World Intellectual Property Organization (WIPO)’s Global Innovation Index (GII),2 one finds a strong, positive correlation (0.757). Furthermore, a country’s GII score has a strong, positive relationship with Yale’s Environmental Performance Index (0.741).

The strong and positive relationship between these two indices makes sense. The policies that make a country economically free are also the ones that encourage entrepreneurial activity.

Innovation and Economic Freedom

Innovation by Economic Freedom Score

Intellectual property rights3 are critical for private sector innovation and breakthroughs in research and development. Intellectual property rights create opportunities for developers to protect their investment in emerging technologies, gain a competitive advantage, and generate revenue from charging for their use of intellectual property. This revenue can then be used to fund future research and investments, creating a positive feedback loop for innovation.4 The Journal of Advanced Pharmaceutical Technology & Research summarizes the importance of intellectual property rights (IPR):

There has been a quantum jump in research and development (R&D) costs with an associated jump in investments required for putting a new technology in the market place. The stakes of the developers of technology have become very high, and hence, the need to protect the knowledge from unlawful use has become expedient, at least for a period, that would ensure recovery of the R&D and other associated costs and adequate profits for continuous investments in R&D…Thus IPR, in this way aids the economic development of a country by promoting healthy competition and encouraging industrial development and economic growth.5

Digging deeper into the relationship between R&D and economic freedom, the IEF’s Government Integrity (0.762) and Property Rights (0.732) subindices show a strong, positive relationship to the GII’s R&D measurement. Further, a country’s per capita GDP has a 0.727 correlation coefficient to its R&D score.

When countries are freer and wealthier, businesses have more resources to fund new technologies, cutting edge research, and to invest more in people through education and scientific institutions. Empirical measurements have estimated that a “one percent change in research and development expenditure will increase GDP per capita by 5 percent.”6 Encouragingly, in 2022, private sector research and development expenditures topped $1 trillion for the first time ever.7

Conversely, weak protections for a person’s or institution’s intellectual property discourage research and development activities. Why invest money and resources if the product or process could be easily stolen or replicated? Weak private property protections cause underinvestment in R&D because “firms do not appropriate all of the returns to innovation, causing the social returns to R&D to be substantially higher than the private returns.”8

In some instances, higher social returns may be welcome, but a system with weak property rights that disincentivizes R&D could ultimately lead to lower public and private returns.

Open markets and government integrity are important to a country’s knowledge and technology outputs, with correlations of 0.743 and 0.753, respectively.9 Business freedom is also a central driver for companies to produce and export technology, ideas, and research. They can expand their customer base and attract the best talent. Efficient and open business operations allow markets and industries to invest in cutting edge software, file patents for emerging technologies, and improve high-tech manufacturing.

Restricting free-flowing commerce, however, drives up the cost to enter the market, shrinking competition, and entrenching leading businesses in industry. Furthermore, while public investment in innovation incubators is beneficial and can generate significant positive economic spillovers, overzealous government spending can stymie innovation. Federal expenditures on research and development, for instance, can reach deprecating gains and crowd out private investment in the space.10 It can also result in significant opportunity costs where politicians allocate taxpayer dollars to their preferred interests rather than what may be more necessary, effective or a legitimate function of the federal government. Cronyism and preferential treatment between agencies and private contractors, or poor oversight on spending can lead to fraud, mismanagement, and abuse. This not only stalls economic progress but also erodes public confidence in institutions and misallocates precious resources that could be spent more productively elsewhere in the economy.

Additionally, poor fiscal policy (low monetary freedom according to IEF) can lead to higher interest rates and more expensive burrowing costs which can discourage financial backing for startups, hamstring venture capital funding, and make it more costly to deploy clean energy systems.11 In November 2023, advanced nuclear company NuScale canceled its power plant in Idaho due to high costs and inflation.12

The concern over high interest rates is highlighted in GII’s report which states, “Global government R&D budgets are expected to grow in real terms in 2022, while R&D expenditure by top corporate spenders rose substantially. But it is unclear whether this can compensate for surging inflation.” Recently, renewable energy companies have been particularly hit hard by high interest rates.13

Yet another problem that can discourage innovation, and the export of innovation abroad, is government restrictions on business freedom by way of subsidies. Preferential treatment allows the government to pick winners and losers – with the winners often being large corporations that do not need support from taxpayers.14 Entrenching special interests shields industries from disruption by making it more expensive and difficult for new companies and entrepreneurs to enter the market or reach a larger customer base.

Protectionist laws inhibit innovation and global clean energy progress. To allegedly remain competitive and appease constituencies, policymakers in industrialized nations are increasingly turning to protectionist policies and centralized planning to subsidize and reshore manufacturing and construction for green technologies such as solar cells and electric vehicles. Regarding the subsidies for domestic clean energy production in the Inflation Reduction Act, research from the European Central Bank (ECB) found that:

Green sectors in America, unsurprisingly, benefit. But producers in other countries lose out so much that ‘the IRA could slow the green transition at global level’. That is an astonishing result. Add in the subsidies and domestic-content requirements implemented by other countries and the drag could be even bigger.15

On the other hand, free trade allows results in more specialization of environmentally-friendly goods. For instance, iron smelters have the choice to purchase metallurgical coke from Argentina instead of Australia, where coke production is three times as dirty. Businesses also have the ability to buy Finnish lumber which emits about one-thirtieth the carbon, per dollar produced, of wood from Indonesia.16

Policymakers should resist the temptations of central planning and protectionism and instead empower the private sector to meet peoples’ needs and address environmental priorities. Property rights, government integrity, and business freedom are integral to unleashing innovation and making breakthroughs that are necessary to reduce global emissions and accelerate human prosperity.

Business Freedom and Tech & Knowledge Outputs

- Enrico Cagno, Andres Ramirez-Portilla, and Andrea Trianni, “Linking energy efficiency and innovation practices: Empirical evidence from the foundry sector,” Energy Policy, August, 2015, https://www.sciencedirect.com/science/article/abs/pii/S0301421515000968[↩]

- The Global Innovation Index (GII) measures a country’s innovation score based on 80 indicators. 64 are hard data, 11 are composite indicators, and five are survey questions (three from the World Economic Forum’s Executive Opinion, two from the Global Entrepreneurship Monitor’s National Expert Survey (NES)). For more detailed information on the GII’s indicators see: https://www.wipo.int/edocs/pubdocs/en/wipo-pub-2000-2023-appendix3-en-appendix-iii-global-innovation-index-2023.pdf[↩]

- For instance, Patents, trademarks, and copyrights. [↩]

- Panagiota Dafniotis, “The green side of intellectual property and its role in energy transition innovation,” Dentons, June 15, 2022, https://www.dentons.com/en/insights/articles/2022/june/15/the-green-side-of-intellectual-property-and-its-role-in-energy-transition-innovation[↩]

- Chandra Nath Saha and Sanjib Bhattacharya, “Intellectual property rights: An overview and implications in pharmaceutical industry,” Journal of Advanced Pharmaceutical Technology & Research, April-June, 2011, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3217699/[↩]

- Sana Surani, Will Gendron, Swati Maredia, “The Economic Impact of Research and Development,” Georgia Tech, April 6, 2017, https://repository.gatech.edu/server/api/core/bitstreams/4b76a27a-9707-429f-9e4c-e28d672ce5a4/content [↩]

- World Intellectual Property Organization (WIPO), “Global Innovation Index 2023, 16th Edition,” 2023, https://www.wipo.int/publications/en/details.jsp?id=4679&plang=EN[↩]

- Brown et al, “What promotes R&D? Comparative evidence from around the world,” Research Policy, March 2017, https://www.sciencedirect.com/science/article/abs/pii/S0048733316302001[↩]

- The GII measures Knowledge and Technology Outputs based on a variety of quantitative variables including the “Number of resident patent applications filed at a given national or regional patent office, the”Number of scientific and technical journal articles,”High tech exports” as a percentage of trade, and more. For the full list see: https://www.wipo.int/edocs/pubdocs/en/wipo-pub-2000-2023-appendix3-en-appendix-iii-global-innovation-index-2023.pdf[↩]

- Nick Loris and Jeff Luse, “Research & Development,” C3 Solutions, 2023, https://www.c3solutions.org/wp-content/uploads/2023/08/RD_CF_2023_Full_Chapter.pdf[↩]

- Julie Steinberg and Joe Wallace, “Inflation Adds to Cost of Clean Energy Transition,” The Wall Street Journal, December, 19, 2021, https://www.wsj.com/articles/inflation-adds-to-cost-of-clean-energy-transition-11639918803[↩]

- Will Wade, “First US Small Nuke Project Canceled After Costs Surge 53%”, Bloomberg, November 8, 2023, https://www.bloomberg.com/news/articles/2023-11-08/first-us-small-nuclear-project-canceled-after-costs-climb-53[↩]

- George Steer, “Renewable energy stocks hit hard by higher interest rates,” October 2, 2023, Financial Times, https://www.ft.com/content/07443afb-b935-492d-8711-8c47e4353c59 [↩]

- Chris Edwards, ”Special Interests and Corporate Welfare,” Cato Institute, 2022, https://www.cato.org/cato-handbook-policymakers/cato-handbook-policymakers-9th-edition-2022/special-interests-corporate-welfare[↩]

- The Economist, “Green protectionism comes with big risks,” October 2, 2023, https://www.economist.com/special-report/2023/10/02/green-protectionism-comes-with-big-risks[↩]

- Eduardo Porter, “Global trade gets a bad rap. But we can’t stop climate change without it.,” The Washington Post, November 15, 2023, https://www.washingtonpost.com/opinions/2023/11/15/global-trade-climate-change-benefits/[↩]